ISSN 2410-5708 / e-ISSN 2313-7215

Year 13 | No. 37 | June - September 2024

© Copyright (2024). National Autonomous University of Nicaragua, Managua.

This document is under a Creative Commons

Attribution-NonCommercial-NoDerivs 4.0 International licence.

Familiarization Internship I of the Banking and Finance major of the I semester 2022 of the Department of Public Accounting and Finance UNAN Managua.

https://doi.org/10.5377/rtu.v13i37.17956

Submitted on August 02nd, 2023 / Accepted on May 23rd, 2024

Erika Janeth Navarrete Mendoza

Master in Finance

PhD student in Education and Social Intervention V Cohort, Universidad Nacional Casimiro Sotelo

Donald de Jesús López Almendares

Master in Business Administration with Emphasis in Marketing

Doctoral Student in Education and Social Intervention V Cohort, Universidad Nacional Casimiro Sotelo

Mercedes Leonor López Almendárez

Graduate in Mathematics

PhD student in Applied Mathematics IV Cohort. Teacher, UNAN Managua

Section: Education

Scientific research article

Keywords: capabilities; companies; internship; simulation

Abstract

The Faculty of Economic Sciences of the UNAN-Managua is divided into departments; within them, the Department of Public Accounting and Finance has two majors, the major of Public Accounting and Finance and the major of Banking and Finance, in the first semester of the year, the major of Banking and Finance takes the internship course of Familiarization I according to what is planned in the curriculum. The Familiarization I internship program has the objective of contributing to the formation of banking professionals and developing skills related to the management of business work forms. It belongs to the professional training area of the Banking and Finance career. It develops skills in the management of accounting activities of assets, liabilities, capital, auxiliary accounts, accounting adjustments, and management of financial statements as necessary elements to be mastered by students of this profession.

The Familiarization Internship I is a complementarity between the qualitative and quantitative methods, which allows the student to know the reality of the labor field specifically in the accounting and financial business area. It is a lasting or lifelong learning, linking learning to be and to do, which contributes to a better understanding of one’s reality and that of society. Simulation is a didactic strategy that favors the training of Banking and Finance professionals in different areas of knowledge.

Introduction

The internship is a subject that is part of the curriculum of the Banking and Finance career, in the Faculty of Economics of the UNAN - Managua and is taught in the V semester. It belongs to the system area of professional training internship, it has no prerequisite to be preceded, but it is necessary for the expected fulfillment in this internship, to have a good command of the preceding subjects such as accounting I, Accounting II, and other basic training.

The structure of the thematic plan of the internship allows the students of Banking and Finance the necessary master of business accounting, management of assets, liabilities, capital, auxiliary accounts, accounting adjustments, and management of the financial statements that are made in the accounting internship, which in turn are of utmost necessity in banking management. This will allow them to enter the labor market as an accounting and/or financial assistant. The scope of the proposed skills will be possible in the realization of this initial internship of the students of Banking and Finance.

Through this Familiarization Internship I, the student will be able to perform practical accounting and financial activities that allow him/her to be able to apply for minor jobs in financial companies in the existing labor market. The skills and abilities acquired correspond to the mastery of the internship of this order, which is executed in the areas under the direction of the financial managers in the companies.

Materials and methods

Following the theoretical references of Hernández, Fernández, and Baptista (2014), the research is situated in a mixed approach precisely because it consists of a set of systematic, empirical, and critical research processes involving the collection and analysis of quantitative and qualitative data.

The research is considered mixed because it processes data of quantitative and qualitative origin. About the former, which presents the number of students doing their internships in the labor field or accounting simulation, the unit of analysis of the present research is constituted by a non-probabilistic sample of students in the first semester of the major of Banking and Finance.

Collection techniques: Two research techniques were applied in the research process: observation and interviews. In the case of the former, according to Arias (2012), “it is a technique that consists of visualizing or capturing by sight, systematically, any fact, phenomenon or situation that occurs in nature or society, according to pre-established research objectives” (p.69).

Regarding the interview, Arias (2012) also expresses that it is “a technique based on a dialogue or conversation ‘face to face’, between the interviewer and the interviewee about a previously determined topic, in such a way that the interviewer can obtain the required information” (p.73). This technique was applied to students and allowed them to deepen aspects related to the Familiarization Internship.

Results and discussion

The educational model, (UNAN Managua,2011) considers professional internship as a mandatory activity, aimed at promoting contact with reality and facilitating the student’s incursion into the working world. However, it is part of the university’s commitment to the student to contrast their theoretical knowledge with practical knowledge, as well as to take advantage of the university’s extension in its direct link with different institutions and society.

According to the Internal Regulations of the internship system of the Department of Public Accounting and Finance (2016). The internship is conceptualized as a student academic internship, which contributes to consolidating the knowledge, skills, and abilities acquired by students, as well as the development of attitudes and values. They are a substantial part of the curriculum and have the objective of interdisciplinary linking the student to his or her future field of work.

Professional internships become a mandatory activity aimed at fostering contact with reality, facilitating the student’s incursion into the working world. This academic activity favors the student’s integral formation process, through the contrast between theoretical knowledge (inter and multidisciplinary) and the practical activity that reality provides. This allows the linkage of the University with the social and productive environment.

According to the Internal Regulations of the internship system of the Department of Public Accounting and Finance (2016). A familiarization internship is one where the student is prepared and familiarized with the work and professional environment in which he/she will develop once the professional training process is completed. This stage will allow them to learn the details of their profession, as well as the obstacles they will face in it. According to the study plan, we have Familiarization I Internship in the V semester, and then Familiarization II Internship in the VI semester. (P.15)

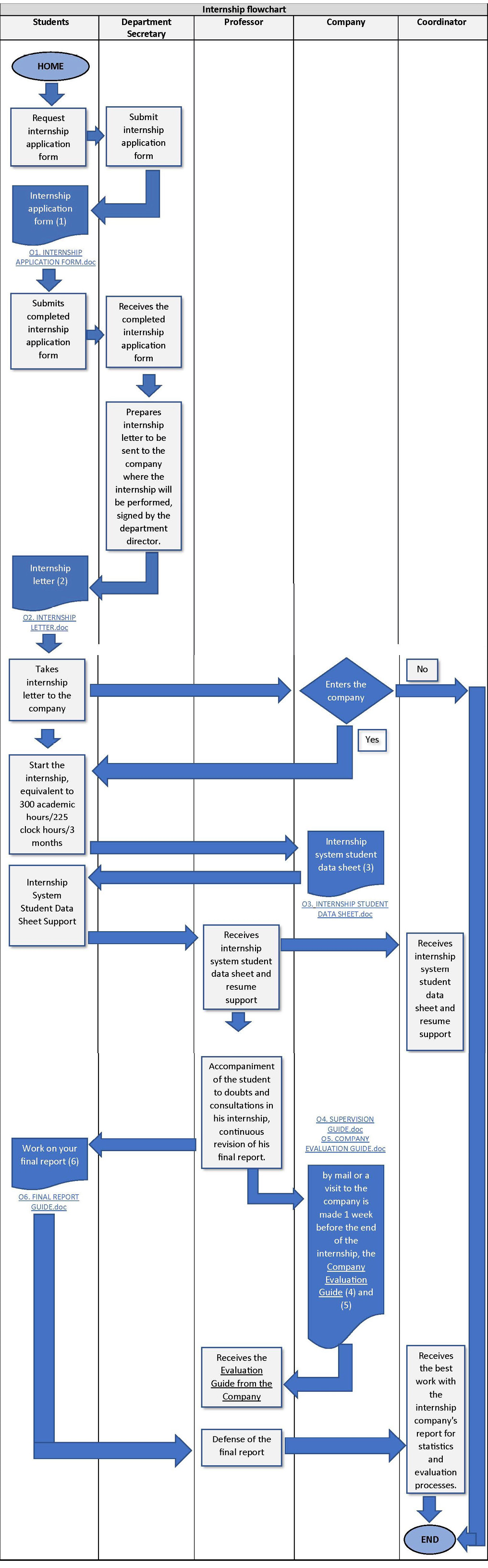

Figure 1.

Flowchart of subjects coming from and sub-subjects of Internships.

Source: Own elaboration. Taken from the Familiarization I internship program (2016). UNAN Managua.

Where in these preceding subjects the students acquired the competencies of the Accounting function as an element of the information system in the different entities, acquired mastery of the techniques for the recording of transactions, knew the nature of the accounts that integrate the financial statements, as well as the legal and regulatory basis, for the preparation and presentation of the financial statements.

The management of internships is developed in two ways, one is the field internship in companies in which there is a process of follow-up and monitoring of the intern by the head assigned to the group, the optional coordinator, and the internship coordinator of the Department of Public Accounting and Finance.

The student is evaluated by the immediate boss of the company where he/she is located, and he must present a certificate from the company and present a report of the activities developed in the company where he/she worked. The following is a flowchart of the process if the internship is carried out in the labor field.

Figure 2. Internship flowchart.

Source: Own elaboration.

Table 1.

Procedure for the use of the flow chart of the internship

|

Procedure for using the internship flowchart |

||

|

Responsible |

Action/Activity |

|

|

Student |

1 |

Visit the accounting department and request the internship application form. |

|

Department Secretary |

2 |

Hand in the internship application form |

|

Student |

3 |

Submits completed internship application form |

|

Department Secretary |

4 |

Receives the completed internship application form |

|

5 |

Prepares letter to be sent to the company where the internship is to be performed, signed by the department director |

|

|

Student |

6 |

Delivers letter to the company |

|

Company |

7 |

Receives the letter |

|

Student |

8 |

After 1 week of being in the company, the student will bring the student's data sheet from the internship system. |

|

9 |

Bring the student's data sheet from the internship system, filled out with his resume. |

|

|

Professor |

10 |

Receive the student's data sheet of the internship system, filled with his resume. |

|

11 |

Accompaniment of the student to doubts and consultations in his internship, continuous review of his final report. |

|

|

Coordinator |

12 |

Receives the student's data sheet from the internship system, filled out with his/her resume. |

|

Professor |

13 |

Sends by mail or visit to the company 1 week before the end of the internship, the evaluation guide of the company. |

|

Student |

14 |

Must present their report to the teacher of their assigned group (defense of the work). |

|

Professor |

15 |

Submit the best work and evaluation guide of the internship coordinating company for statistics and internship evaluation processes. |

Source: Own elaboration.

As a requirement for students to perform their internships in the labor field, they must perform their internships in any area related to the accounting process (accounting records, archives, cash, checks, reconciliations, inventories, financial statements, among others), to put into practice the knowledge acquired in the relevant subjects. There is also the option of elaborating the accounting process for small and medium-sized companies or informal businesses that do not keep accounting records, where students can contribute to society and consolidate their knowledge in the labor field.

The following testimony presents the strengths and weaknesses in the realization of internships in the labor field.

Largaespada, H. R (2022)

“My weakness in the labor field is that I am without experience in the labor field but I am motivated in strengthening myself in the quick capture of the necessary knowledge to be able to perform any activity that I need in the department where I am doing the internship with the excellent ethical values acquired in the University and put during this period to be able to work under pressure to deliver in time and form to each of the assignments and perform excellent work to be well referenced as a professional and as a University.”

Simulation as a learning strategy in the Banking and Finance major. According to Orozco, Cruz, and Días, (2022), in their article Simulation as a Didactic Strategy in Teacher Training. Simulation is a group learning strategy that allows students to develop empathetic processes and take on roles in the representation of circumstances, facts, or events. This strategy has been used in various areas of knowledge to generate significant experiences in students so that this knowledge is internalized, lasting, and applied to other situations.

Accordingly, Davini (2008) argues that simulation is a “teaching method that aims to bring students closer to situations and elements similar to reality, but in an artificial form, to train them in practical and operational skills when they face them in the real world” (p. 144).

According to Pimienta (2012), simulation is conceived as “a strategy that aims to represent life situations in which students participate by playing roles to solve a problem or simply to experience a given situation” (p.130).

Another way for the student to develop the internship is through a simulation in the classroom, with the assigned teacher, where the programmatic content of this practice of Familiarization Internship I, develops the Introduction to the practice of familiarization; accounting records in general ledger scheme; registration and use of accounting books, preparation of financial statements, financial analysis, complementary operations, culminating with an end-of-course work. With the experiences in the classroom simulations, it begins with the legal and regulatory basis for the creation of an entity, preparation of items, and initial financial statements, in the course of the weeks simulate items that include movements of cash and cash equivalents, accounts receivable, inventories, property, plant and equipment, liabilities, equity, adjustments, reclassifications, worksheets, preparation of final financial statements, daily and general ledgers up to the preparation of the income tax return, taking all these with their primary and secondary supports such as daily vouchers, payment vouchers, checks, invoices, receipts, boucher, withholdings, quotations, among others, to simulate what is carried in the reality of the labor field and that they have the competencies when they develop in the professional field.

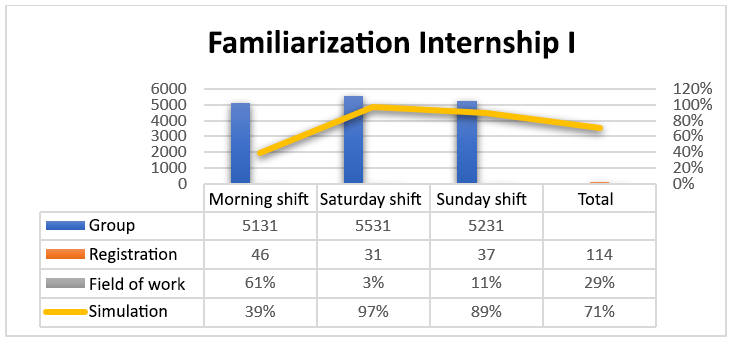

As for the internship in the first semester of the year 2022 corresponded to 3 groups: Group 5131 morning shift, group 5231 Saturday, and Group 5531 Sunday, of Familiarization Internship I of the III year of the major of Banking and Finance.`

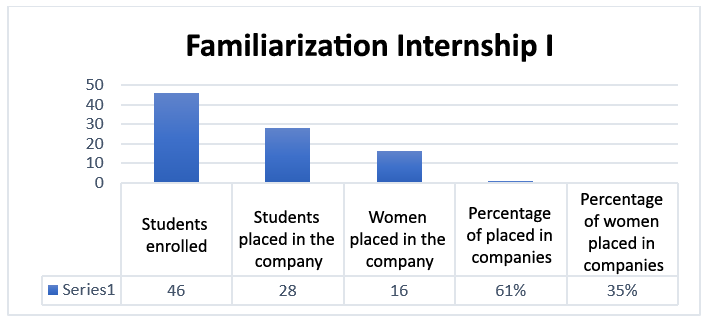

Figure 3.

Group 5131 morning shift.

Source: Own elaboration.

Figure 3 shows that Group 5131 of Banking and Finance of the III year of the morning shift indicates that of the total of 46 students enrolled, a total of 28 students were placed in companies, representing 61% of 100% of the group, and 16 women were placed out of the total of 28 students, representing 35% of 100%. This indicates that the placement in the companies was very successful in more than 50%, where the students put into practice the learning in the labor field. Thirty-nine percent carried out the simulations in the classroom.

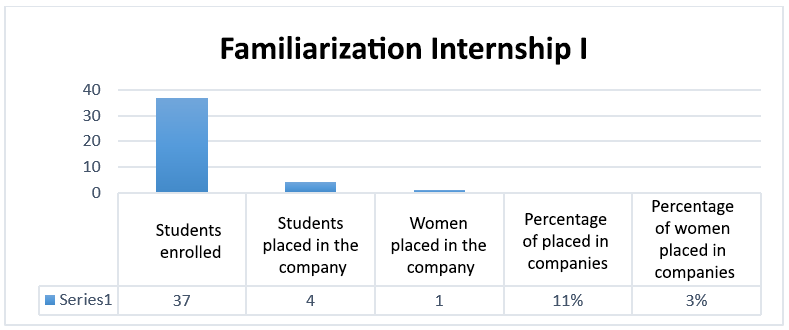

Figure 4.

Group 5531 Saturday shift.

Source: Own elaboration.

Figure 4 shows that the Banking and Finance group 5531 of the III year of the Saturday shift indicates that of the total number of students enrolled, 37, a total of 1 student was placed in the companies, representing 3% of 100% of the group. This indicates that the placement in companies was minimal, which is very important data to follow up on in the following semesters since most of these students are already working and it is interesting to know if it was due to a lack of feedback on the internship modalities or if the students wanted to enrich their knowledge with the simulations in the classroom.

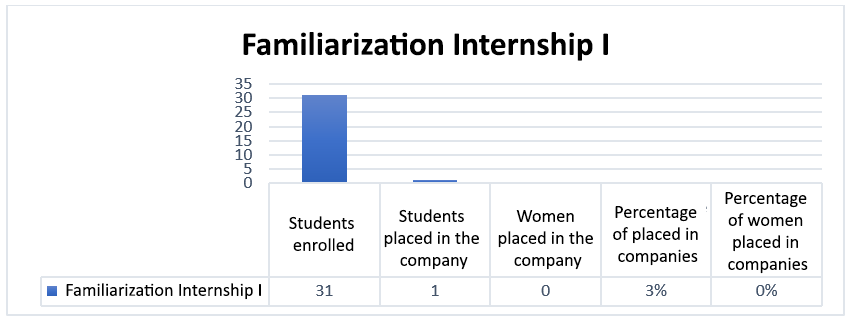

Figure 5.

Group 5231 Sunday shift.

Source: Own elaboration.

Figure 5, shows that Group 5231 of Banking and Finance of the III year of the Sunday shift indicates that of the total number of students enrolled, which were 37, a total of 4 students were placed in companies, representing 11% of 100% of the group, and 1 woman was placed out of the total of 4 students, representing 3% of 100%. This indicates that the placement in the companies was minimal, 11%, which means that they should be more in the labor field since it is a population of students who work and it is very important to make the internship process known to the students. Obtaining 89% of students performing the Familiarization I Internship in simulations in the classroom.

Figure 6.

Familiarization Internship I (work field or simulation), I semester 2022.

Source: Own elaboration.

Figure 6 summarizes that in the first semester of 2022, in groups 5131,5531,5231, 114 students were enrolled, and 33 students were placed, equivalent to 29% with a 15% participation of women, 71% of them performed simulations in classrooms, which indicates that there is an arduous task to be able to insert more students in the business field so that they can acquire professional experience.

Conclusion

The Familiarization Internship I is a complementarity between the qualitative and quantitative methods, which allows the student to know the reality of the labor field specifically in the accounting and financial business area. It is an enduring or lifelong learning, which links learning to be (critical thinking, opportunities to put it into practice and develop their judgments); and to do (getting involved and testing their ideas will build the structures of their knowledge), which contributes to a better understanding of their own and society’s reality.

Simulation is a didactic strategy that favors the training of Banking and Finance professionals in different areas of knowledge. Through this strategy, empathic processes are carried out that allow the protagonists to assume roles similar to those they must assume in reality, and, therefore, to appropriate the role, knowledge, attitudes, and skills that the environment requires to perform effectively.

The research compiles the Familiarization Internship I of Banking and Finance major of the I semester 2022 of the Department of Public Accounting and Finance UNAN Managua. It is concluded that this internship is carried out by two means the labor field and through simulations in the classroom, so that the protagonists acquire experiences in the accounting processes of the reality of the labor field where it was known that in the first semester of 2022, the groups 5131,5531,5231, 114 students were enrolled, 33 students were placed in the labor field, equivalent to 29% and 71% through simulations in the classrooms, which indicates that there is a hard task in the Familiarization Internship I, to be able to insert more students in the business field and that the simulations comply with all the requirements for them to acquire the competencies and be able to develop in the professional field.

Works Cited

Davini, M. (2008). Métodos de enseñanza: Didáctica general para maestros y profesores. Buenos Aires: Santillana.

Gazo, R. J (2018). Prácticas profesionales, Proyección y Extensión Social. Aproximación a la experiencia de la Facultad de Humanidades y Ciencias Jurídicas 2014-2015. https://www.lamjol.info/index.php/torreon/article/view/7714

Gómez, G.R (2015). La investigación desde las prácticas de Familiarización. https://multiensayos.unan.edu.ni/index.php/multiensayos/article/download/103/104/

Gutiérrez, V.J (2022). Reporte de prácticas de Familiarización I Banca y Finanzas Grupo 5231.

Morales, G. E (2022). Reporte de prácticas de Familiarización I Banca y Finanzas Grupo 5131.

Orozco, A.J, Cruz, A.A y Días, P.A (2022). la Simulación como estrategia didáctica en la formación docente. Experiencia en la carrera de Ciencias Sociales.

Pimienta, J. (2012). Estrategias de enseñanza-aprendizaje. Docencia universitaria basada en competencias. México: Pearson.

Universidad Nacional Autónoma de Nicaragua, Managua (2014). Programa de prácticas de Familiarización I Banca y Finanzas. UNAN Managua